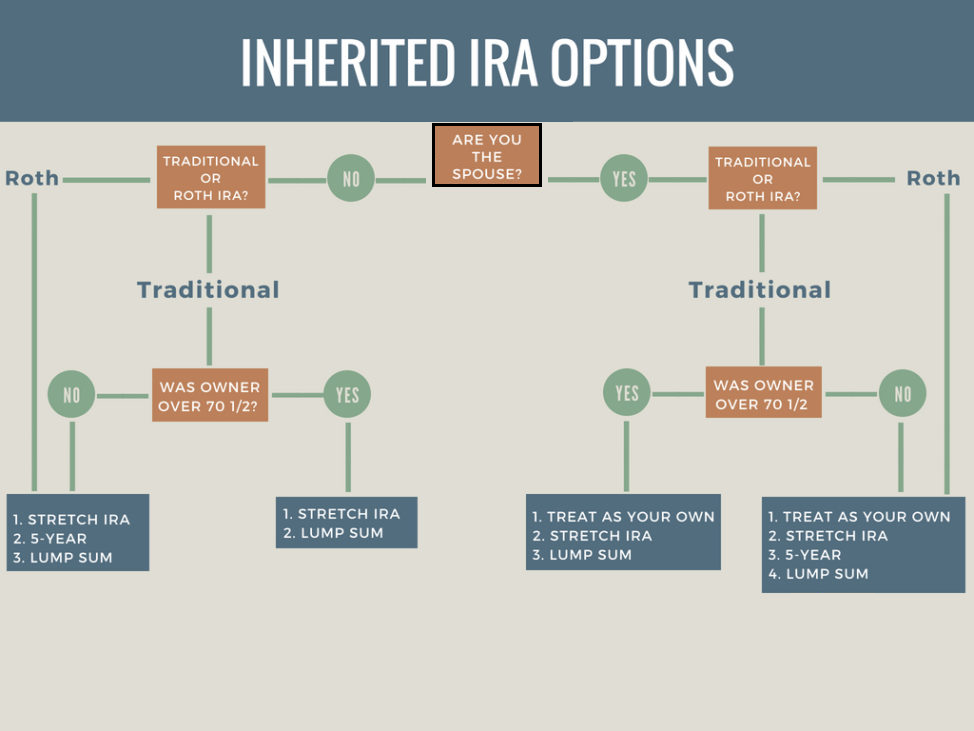

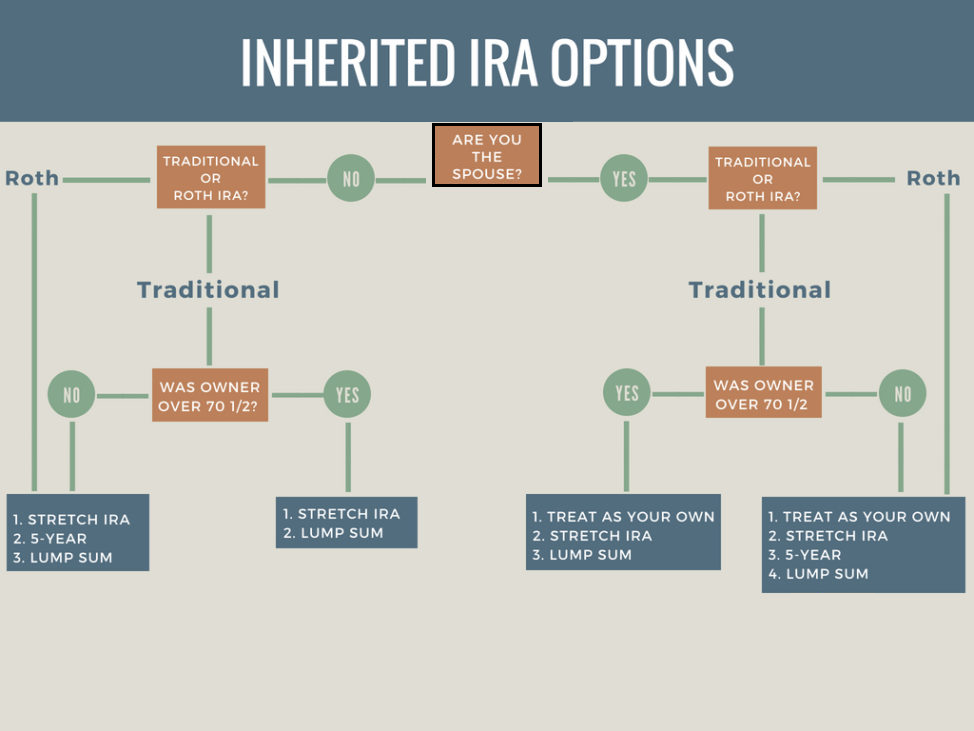

A Roth IRA rollover involves moving retirement funds from one account to another such as rolling 401k funds into a Roth IRA account. This Flowchart will guide you in choosing the best option for your circumstance.

When It S A Bad Deal To Inherit A Roth Ira

We use cookies to give you the.

. But with the SECURE Act taxes are bunched into a 10-year period and can substantially erode the value of an inherited traditional IRA. How does the tax liability work. Ad Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions.

Are there required - Answered by a verified Tax Professional. The max contribution for. If youve opened a traditional individual retirement account you designated an IRA beneficiary in the.

Ad Decide Which IRA is Right For You with the Help of Fidelity. In this case the traditional IRA is a better bet than the ROTH. Contributions can come from Pre- or post-tax dollars.

Traditional IRA contributions vs. Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. Roth IRAs For those who already.

Can I Convert an Inherited IRA into an Inherited Roth IRA. Should I invest in a Traditional or Roth IRA. That being said people love ROTH IRAs.

Check Out Our Infographic. Saving in an IRA makes sense whether you have a retirement plan at work or not but investors then have to decide if a traditional or Roth account is better as always it. Ad Get Help Determining Which IRA Is Beneficial For Your Situation.

Take Control Of Your Future And Open An IRA That Suits Your Retirement Needs. Which is Better - a Traditional IRA or a Roth IRA. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Ask the Hammer. A Roth IRA conversion however involves. Is it better to inherit a traditional ira or a roth ira.

If you inherit a Roth IRA from someone other than your spouse you are not permitted to make contributions to the inherited Roth IRA or combine it with any Roth IRA you established for. Theres no such thing as too much money for retirement whether you save it or inherit it. Which makes the most sense for you.

1 Understand your options. A reader questions his choice of rolling. Heres what you need to do if you inherit an IRA.

A traditional 401k or if your employer offers one a Roth 401k. A Roth IRA that is opened the same day and has an identical contribution history and interest rate as a traditional IRA has the potential to net more to the heir. Whether you choose a Roth or traditional IRA you will be setting yourself up for economic stability later in life.

Ad Decide Which IRA is Right For You with the Help of Fidelity. If you have more questions on Roth vs traditional IRAs and how. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

You can private and fund every a Roth and a normal IRA assuming youre eligible for each. With a traditional 401k plan your contributions are made on a pre-tax basis. One straightforward rule that applies to all beneficiaries is that the tax treatment of the IRA.

They love the idea of tax-free growth forever and leaving a tax-free inheritance to their. But your full deposits in all accounts shouldnt exceed the overall. This is because contributions.

You can inherit a Roth individual retirement account IRA and avoid a lengthy court process known as probate as long as the person who passed away listed you as a.

Inheriting An Ira From Your Spouse Know Your Options New Century Investments

0 Comments